Welcome to our Customer Service Center where we will help you find a solution and answer your questions.

-

Apply

-

Deposit

-

Transfer

-

Make payments

-

Manage your account

-

FAQs

-

Watch and Learn

FOR INDIVIDUALS

Apply from wherever you want, at any time.

FOR BUSINESSES

Complete your business application without having to visit a branch.

FOR INDIVIDUALS

Deposit checks from your mobile device.

Deposit checks quickly, conveniently and securely anytime, anywhere using your mobile device through the Digital Banking app.

-

You can deposit up to $10,000 per check, per day; and up to $20,000 per month.

-

Remember to place the check on a flat surface with good lighting.

Deposits sent before 7:00 p.m., on regular business days, will be processed the same day, subject to verification and validation of the deposit.

Deposit checks and cash in our ATMs 24/7.

Find the nearest ATMs with First Deposit here.

1. Insert your FirstBank debit card into any of our ATMs with the First Deposit logo.

2. Select the deposit transaction.

Choose to deposit:

Checks

Maximum amount in new accounts (less than 90 days):

- $2,500 per check

- $5,000 daily

Maximum amount in existing accounts over 90 days old:

- $5,000 per check

- $10,000 daily

Cash

Maximum amount in new accounts (less than 90 days):

- 75 bills per deposit

- $2,500 daily

Maximum amount in existing accounts over 90 days old:

- 75 bills per deposit

- $10,000 daily

3. Confirm your deposit amount.

4. Get an image of the deposited check and/or cash deposit detail on the receipt.

5. Your deposited check will be processed the same day if deposited before 7:00 p.m., and your cash deposit will be instantly available1.

FOR BUSINESSES

Deposit from wherever you want.

Deposit checks through your mobile phone 24/7 with Mobile Smart Check.1

You can also:

-

Make cash deposits from your locations in a quick and convenient way with Smart Cash.

-

With the Night Depository service, you can deposit in the drop box at any of our branches at any time during the night and have the funds available in your account the next business day.

Activate services or receive a quote free of charge.

Call our First Commercial Service Center at 787-729-9290 (option #2) Monday to Friday from 7:30 a.m. to 5:30 p.m.

1Checks deposited before 7:00 p.m. on business days will be accepted and processed the same day. Deposits made after this time will be accepted and processed the next business day. FirstBank will consider the date of processing to be the day the deposit was made. Your deposit will be available as per our Fund Availability Policy, included in the Account Agreement. Cash deposited on business days before 3 p.m. will be instantly available for all transaction types. After 3:00 p.m., the effective deposit date will be the next business day, but the deposit will be available for online transactions such as ATM withdrawals and transfers, point of sales (POS) purchases, and transfers between accounts through our Internet Banking or Mobile Banking services. The maximum cash amount for deposits in new accounts (with less than 90 days open) is $2,500 per day, while for existing accounts (with more than 90 days open) is $10,000 per day. The maximum amount for each check is $2,500 for new accounts, with a limit of $5,000 per day; while for existing accounts the maximum for each check is $5,000, with a limit of $10,000 per day. Member FDIC in USVI only.

FOR INDIVIDUALS

Transfer money with flexibility and security.

Through Digital Banking you can make the following types of transfers:

-

Between your accounts

Transfer money between your checking or savings accounts.

-

Between FirstBank accounts

Transfer money to people with checking and savings accounts at FirstBank. You can also schedule your transfers to run automatically as often as you need, and on the dates that you want.

-

To accounts from other financial institutions

Transfer money safely to accounts from other financial institutions in Puerto Rico, U.S. Virgin Islands and the United States. For your peace of mind and security, each transfer to another person will have to be validated by entering a temporary transfer code.

With ATH Móvil you will be able to:

Transfer money from person

to person

Make donations to nonprofit organizations

Make transfers between

your cards

Pay at participating ATH Móvil Business merchants

If you like, you can also make transfers:

At our branches

Find the nearest branch here so that you can pay your credit cards, loans, mortgage, bills, and lines of credit.

FOR BUSINESSES

Transfer money with flexibility and security.

Subject to terms and conditions. To use ATH Móvil, both the owner of the account that will receive the transfer and the sender of the transfer must be registered with the service. To register you must have an active debit card with a financial institution participating in the ATH Móvil service. Certain fees may apply for transfers. Download the ATH Móvil application to register, and view the terms and conditions of use of the service and a list of participating institutions. ATH Móvil is a service of EVERTEC Group's ATH Network.

FOR INDIVIDUALS

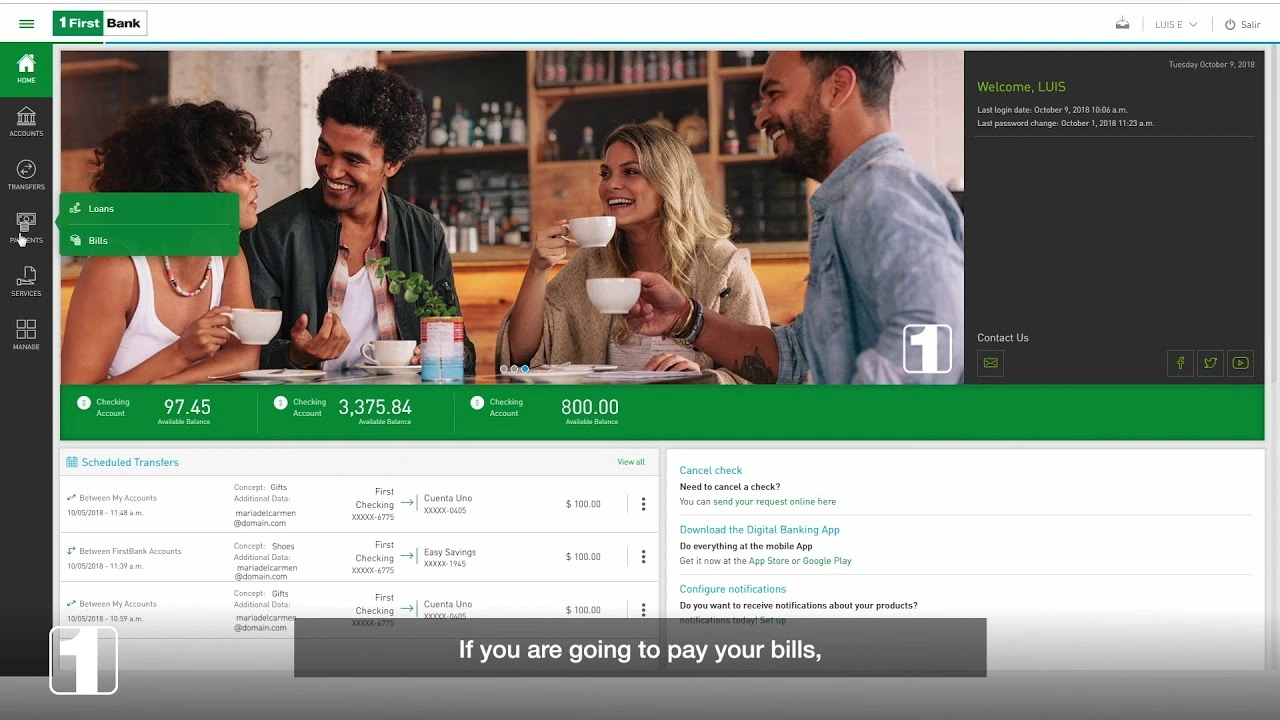

Make payments wherever and whenever you want.

Through our Digital Banking platform, you can pay:

-

Bills

Issue payments to over 4,000 registered merchants and/or towards any loans and credit cards you may have in other financial institutions from your FirstBank accounts.

-

Loans, credit cards, and lines of credit

Pay your FirstBank mortgage loans, personal loans, boat loans, auto loans and leases, credit cards, and lines of credit with your FirstBank accounts or user accounts from other financial institutions in Puerto Rico and the United States.

-

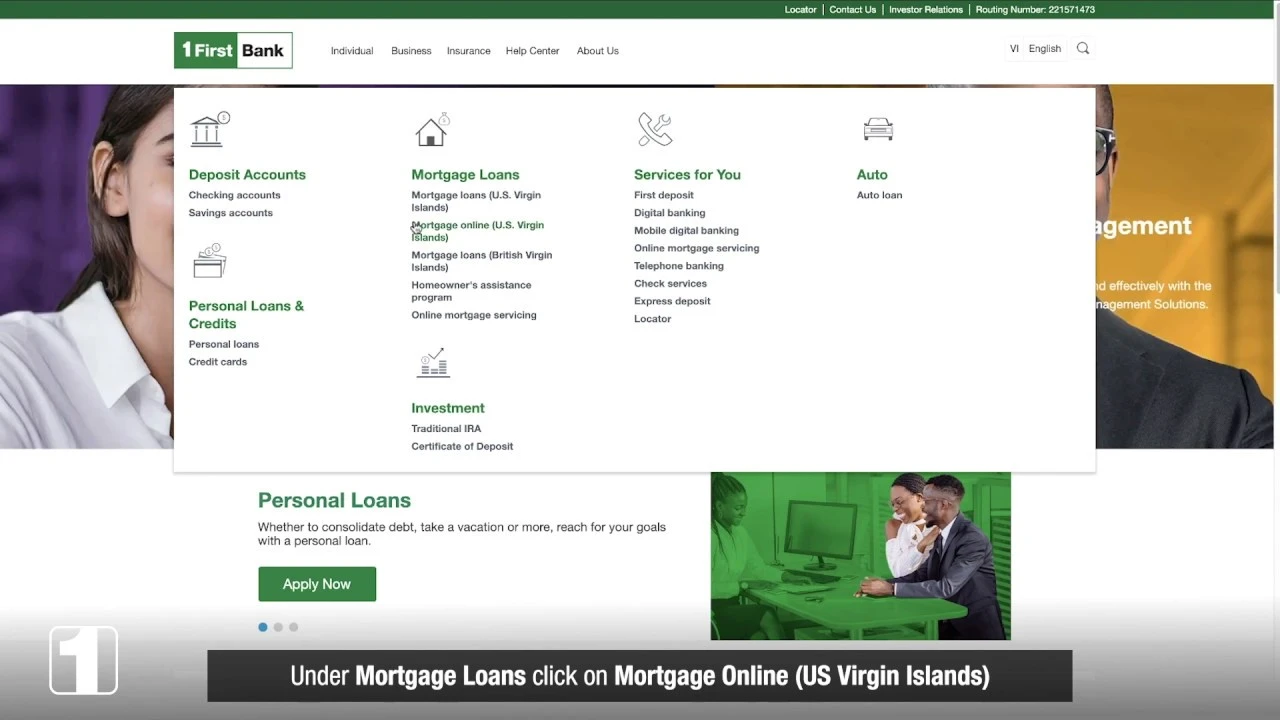

Mortgage

Enroll and pay your FirstBank mortgage online.

You can also make payments:

It’s easy! Call 340-775-8899 (for USVI), 284-495-8899 (for BVI), or toll-free at 1-866-695-2511.

Leave your wallet behind.

Register your Beyond credit card with Google Pay or Samsung Pay and start enjoying faster and more secure transactions.

Easy Enrollment

Just enter your information and security codes, then add the card number, validate it, and sign on the screen.

Enhanced Security

Access with your fingerprint or security code to perform each transaction. In addition, your card is encrypted to keep your data protected.

Speed Up the Purchase Process

Just hold your phone up to the machine to pay, and that's it!

Discover Beyond Mobile and simplify the entire purchase process.

Add your Beyond credit card today. Select one of the following options:

Subject to approval and/or availability on your credit line. Samsung Pay, Android Pay, and Google Pay services are subject to the terms and conditions of those providers. FirstBank is not a Digital Wallet service provider and we are not responsible for any failure or inadequacy that prevents you from making a Digital Wallet transaction. FirstBank is only responsible for securely providing information to the Wallet service provider in order to allow the use of the Beyond card in the Digital Wallet. Digital Wallet services are provided by third parties (each of them a 'Digital Wallet Provider'), and you may only use Digital Wallet services from a Provider that has been approved by FirstBank. FirstBank may withdraw such approval at any time at its discretion. See FirstBank's terms and conditions for the Digital Wallet here.

Enjoy the convenience of making payments without going to a branch.

Make utility and supplier payments in a single system,

Our Commercial Bill Payment service allows you to issue, schedule, or cancel electronic bill payments from the list of merchants previously defined in our payment platform.

Activate services or receive a quote free of charge.

Call our First Commercial Service Center at 787-729-9290 (option #2) Monday to Friday from 7:30 a.m. to 5:30 p.m.

FOR INDIVIDUALS

Managing your accounts is easy.

With Digital Banking:

-

Quickly and safely access your account information.

-

See balances.

-

Download the transaction history of your deposit accounts, credit cards, loans, and lines of credit.

Services for your accounts:

-

Create travel notifications.

-

Cancel and replace your debit or credit card.

-

Activate and download a copy of your e-Statements (or electronic statements).

-

Request checking or savings account certifications.

-

Reorder checks.

-

Manage the cancellation of check payments.

-

Authorize FirstBank to contact you.

Through Digital Banking, you will be able to:

Set up alerts in order to receive email messages regarding your account balance and/or transactions made. For your convenience, you can set the parameters and frequency of these alerts.

Reduce paper waste by signing up for e-Statement through Digital Banking so you have access to your account statements only in electronic format. You will have access to your statement history for up to 18 months.

Keep track of your money easily and effectively with the budget management tool. Here you can view your income and expenses by category. In addition, you can define a budget to manage your expenses efficiently and create savings goals.

Start enjoying the convenience of accessing your FirstBank mortgage without having to visit the branch! Downloading documents, making payments, and accessing all your loan information has never been easier! Register now!

Start managing your business 24/7 from anywhere.

Download the app and request information about other tools that we have available for your business.

Manage your business with all these benefits:

-

Access your account information

-

Make transfers between accounts linked to your profile

-

Approve ACH and wire transactions, and Positive Pay and ACH Positive Pay exceptions

-

Deposit checks through your mobile phone 24/7 with Mobile Smart Check

Activate services or receive a quote free of charge.

Call our First Commercial Service Center at 787-729-9290 (option #2) Monday to Friday from 7:30 a.m. to 5:30 p.m.

-

Personal

-

Business

We answer your questions.

DEPOSIT ACCOUNTS

Checking accounts

Convenience Checking Account

The Convenience Checking Account is easy to manage. It has a fixed monthly fee and free withdrawals per cycle. It is designed for those who make online transactions.

Yes, you have the option to choose between an ATH debit card and a Visa debit card. Both give you the option to register with ATH Móvil.

You can open a checking account for only $1.00. That simple.

If you have a question, you can have 24-hour access to your account through FirstLine Solutions Center and Digital Banking.

Personal Checking Account

To enroll with ATH Móvil you must have an active debit card. Go to www.athmovil.com to enroll and view the terms and conditions of service and list of participating institutions and merchants. ATH Móvil is an ATH network service from EVERTEC Group, LLC.

If a minimum average daily balance of $1,000 is maintained, there is no service fee. There is no monthly account maintenance for customers 65 years and older or under the age of 18 years.

Power One

No. You must place an order for checks. There is a fee and charge that vary depending on the account. For more information, you can call us.

Yes, our Personal Checking and Power One checking accounts give you competitive interest rates. These are annual interest rates and percentage yield (APY) may vary at the discretion of FirstBank based on market conditions and may change without prior notice.

To see your account balances, you must first register with Digital Banking. You can also see your balance on your phone if you have a debit card and register with ATH Móvil.

Savings accounts

Maximizer Savings Account

To open a savings account all you need is your Social Security card, proof of residence and two valid photo IDs. The deposit will depend on the type of account. You can call us at 1-866-695-2511 for USVI or 1-284-495-8899 for BVI.

Yes, the Maximizer Savings Account allows you to earn higher interest and access your funds. You can make withdrawals without penalty, other than loss of interest.

Yes, you get an ATH debit card. It gives you the option to register with ATH Móvil.

Statement Savings Account

With $100 you can open a Statement Savings Account. You can waive the fees if you maintain a minimum average daily balance of $300.

A Statement Savings Account gives you the benefit of earning competitive interest, waive fees, and access to a debit card.

To see your account balances, you must first register with Digital Banking. You can also see your balance on your phone if you have a debit card and register with ATH Móvil.

Minor Statement Savings Account

With the Minor Statement Savings Account, you can encourage your kids to save and develop math skills. No charges or fees apply as long as the child is under 18 years old.

You can open a Minor Statement Savings Account for only $ 50.00. There are no fees or service charges.

This account pays competitive interest rates depending on the balance of the account.

IRA Accounts

An IRA is an Individual Retirement Account.

IRAs allow you to save money for your retirement, thus complementing your social security income. In addition, it gives you a tax benefit.

To open an IRA, you must have two valid photo IDs issued by the United States government, and a Social Security card. Additional forms may be requested.

IRAs are only available in USVI.

Certificate of Deposit CD

The IRA and CD accounts both allow you to save money for your future. The IRA gives you a tax benefit. The CD account is a deposit account with a defined term.

The minimum to open a Certificate of Deposit is $2,500.

A Certificate of Deposit is a smart way to save. It gives you the advantage of fixed rates for a term ranging from thirty days to three years and can be used as collateral for a personal loan.

LOANS

Personal Loan

- Get pre-qualification by completing the application online.

- Select the loan type: with collateral, or without collateral

- Purpose of the loan: debt consolidation, home improvements, medical expenses, funeral expenses, educational expenses, taxes, vacation

- Amount of the loan from $1,500 up to $25,000

- Term of the loan 12, 24, 60, 72 months

- Personal Information

- Additional information may be requested

One of our employees will contact you or email you.

Yes, all you need to do is register with Digital Banking, and make a payment, or schedule autopay. You can also check your account balances.

- Valid driver’s license

- Proof of income: last two (2) pay stubs, or financial statements if you are self-employed

- Proof of Social Security/pension, or bank statements reflecting such deposits, if applicable

- Proof of residence: utility bill (water, electricity, telephone bill) lease agreement, etc.

Taxi Medallion Loan

Only available in USVI. You can get up to 80% of the value.

Yes, you get the cash from the Taxi Medallion you own when you need it.

Yes, you can complete the pre-application process online. One of our employees will contact you.

Auto Loan

- Valid driver’s license

- Proof of income: last two (2) pay stubs, or financial statements if you are self-employed

- Proof of Social Security/pension, or bank statements reflecting such deposits, if applicable

- Proof of residence: utility bill (water or electricity), lease agreement, vehicle registration

- A copy of the dealer’s invoice, purchase order or bill of sales of the vehicle to be financed

You can apply for an auto loan by visiting your nearest dealership in the USVI or the Road Town Branch in the BVI.

Yes, we provide financing on all brands (New or Used).

CREDIT CARDS

Beyond Mobile

Beyond Mobile is a service that lets you register your credit card information and make in-store payments without a physical credit card. This service and/or application is also known as digital wallet. You will be able to set up the card of your choice to be the primary payment method. If you wish to use a secondary card, you only need to open the application and select your card of preference.

You may use the following applications:

- Samsung Pay

- Google Pay

Apple Pay is currently unavailable for banks in Puerto Rico.

Both are digital wallet services. These applications are readily available or may be installed in most Android smartphones or tablets. When you subscribe to a digital wallet service, your physical credit card number is replaced by a virtual credit card number or token during transactions at stores with enabled terminals for this type of transaction. This substitution for virtual credit card numbers also happens with Beyond Visa and Mastercard credit cards.

You will be able to add any FirstBank Beyond Visa or Mastercard credit card issued in Puerto Rico and Beyond Mastercard issued in USVI in your digital wallet. Visa Debit and Business Visa Debit cards cannot be registered in the digital wallet.

- Access the digital wallet service.

- Enter your credit card information.

- Read and accept the terms and conditions.

- Choose how you want to receive the token (text message or email).

- Enter the code you received as your verification method.

- You will receive a confirmation.

You may use Samsung Pay and Google Pay at any participating establishment in Puerto Rico and in other countries with compatible technology.

Some businesses that accept Google Pay are: Aerie, Aeropostale, American Eagle, Best Buy, Claire's, Disney Store, Foot Locker, Gap, Gymboree, Macy's, Nike, Old Navy, OfficeMax, Petco, PepBoys, Toys R Us, Walgreens, and Walmart, among others.

Samsung Pay works in most stores with point of sale (POS) terminals.

It may not be used at automatic teller machines or any other terminal where the card needs to be physically inserted.

These services are mostly compatible with Android devices.

Yes, because they replace the Beyond Visa or Mastercard credit card number with a unique token assigned to the digital/mobile wallet. Also, you will need to provide the fingerprint or PIN assigned to your mobile to authorize in-store purchases.

Please remember that smart phones are like small computers, which means you need to keep the software updated and set up your device passwords. To ensure your safety when using these systems, be mindful of where you connect and avoid using Wi-Fi to access your banking information.

Also, make sure that the websites you visit or use to make online purchases require a username and password. And lastly, remember to never share your passwords with anyone.

Not all digital/mobile wallets use tokens, which means not all digital wallets have this added security factor.

The service is free of charge. However, to enroll and pay with a digital wallet, your device must have an active data plan.

Although they look the same and allow you very similar functionalities, each digital wallet uses a different technology to make purchases at different merchants.

Yes, your physical card will continue to work as usual.

Yes, you may delete it at any time. Open the digital/mobile wallet, click on your card image and select the Delete option.

You may use Samsung Pay if you have any of the following Samsung devices: Galaxy S8, Galaxy S8+, Galaxy Note 8, Galaxy S7 edge, Galaxy S7, Galaxy S6, Galaxy S6 edge, Galaxy S6 edge+, Galaxy A5, or more recent. You may use Google Pay in any device with Android 4.4 KitKat or higher.

Most of the transactions made with the digital wallet are visible shortly after they are made and for up to one month. Simply open the wallet and click on the desired card to see the latest transactions made with that card.

Return policies will vary by merchant. You may return items purchased with Samsung Pay or Google Pay the following way:

- Provide the merchant with the last four digits of your digital credit card instead of your physical card's account number.

- Use the physical card with which you made the Samsung Pay or Google Pay purchases.

Please remember to keep the original receipt you received from the merchant at the time of purchase. The transaction details in Samsung Pay or Google Pay are not an official receipt.

If you change your phone or tablet, we recommend you delete the information from the device using the Factory Reset function. This process will erase all the information, including digital wallets.

When you get a new phone or tablet, you will need to register your cards in the digital wallets again, following the same steps as in the initial registration.

If you receive a new Beyond Visa or Mastercard credit card, you need to open the application, delete the existing credit card, and add the new one.

If your phone was stolen or has been compromised in any way, please call 1.855.701.2265 immediately to report it and take the corresponding measures.

The purchases you make with Samsung Pay or Google Pay will enjoy the same protection as those made with your physical card. It’s important that you contact the Bank promptly if you identify any unauthorized transactions. Immediately call 1.855.701.2265 to report them.

You need to contact your mobile phone provider to check whether your device is enabled to offer the Samsung Pay and Google Pay features.

Yes, you may register more than one card. You may choose to pay with any of the cards, however, but you can also set up one of them to be the preferred card. This way, you only need to bring your device up close to the POS, and that's it! You don't even need to open the application. You just need to bring your device up close.

Yes, you may add your credit card to your digital wallet in multiple mobile devices.

You should visit Samsung Pay Help Center or Google Pay Help Center.

CREDIT CARD REWARDS PROGRAM

When you open a FirstBank credit card you are automatically enrolled in our Rewards Program!

No, it is free of charge.

You can redeem points online 24/7 at www.rewardsfirstbank.com or by calling a Customer Service Representative at 1-855-701-BANK (2265) from Monday through Sunday from 6:00 a.m. to 12:00 a.m. (AST) Travel customer service representatives are available from 9:00 a.m. to 9:30 p.m. (EST) Monday through Friday, and 9:00 a.m. to 6:00 p.m. (EST) on Saturdays.

DIGITAL BANKING

Enrollment

Digital Banking is the online service platform that brings together all your FirstBank deposit accounts, credit cards, loans and lines of credit. Through Digital Banking, you can check balances, view and/or download your account transactions, issue payments to over 4,000 merchants, pay your loans and credit cards in other financial institutions from your FirstBank accounts, and pay your FirstBank loans, credit cards, and lines of credit. You can also transfer funds between your own accounts, with other FirstBank accounts or to other financial institutions in U.S. Virgin Islands, Puerto Rico and the United States. You can also make mobile deposits through FirstBank’s Digital Banking app. In addition, you can make travel notifications, credit or debit card replacements, among others.

Signing up for Digital Banking is easy. Access the step-by-step guide that shows you how to do it and start enjoying all its benefits today. Learn more

You can log into Digital Banking through the online services section in 1firstbank.com or directly visiting digitalbanking.1firstbank.com.

Click here and follow the steps to unlock your username.

- It allows you to access and check your account balances quickly and securely

- You can use your FirstBank accounts to pay bills to over 4,000 registered merchants, and you can pay your FirstBank loans, credit cards, and credit lines with your FirstBank accounts or with accounts from other financial institutions in Puerto Rico, U.S. Virgin Islands and the United States

- You may transfer money between FirstBank accounts and other financial institutions in Puerto Rico, U.S. Virgin Islands and the United States

- It allows you to deposit checks from your smartphone with Mobile First Deposit

- It includes a mobile application that offers quick and secure access to your accounts by implementing Touch ID and Face ID in supported devices

- You can set up alerts and receive notifications by email and/or to your phone, for balances and transactions completed in the platform.

- You can manage services online for your accounts, such as travel notifications, credit or debit card cancellations, suspend check payments, and more

- You can see a visual display of your incomes and expenses, manage your budget, and set up savings goals through the Your Finances module

- It provides a consistent and adaptable experience throughout all your devices

- You may select either English or Spanish as your preferred language to manage your accounts

Yes. Once you have updated your information in Digital Banking you can download the app in the App Store or in Google Play. Access your information with Digital Banking’s username and password.

Security

With Digital Banking you will have enhanced security. Digital Banking features three additional security settings to secure your information:

- Security image

- Question and secret answer

- 4-digit PIN

You will also be able to access your information through the mobile app with Touch ID or Face ID in devices that support such technology.

You will receive native security alerts to notify you about account activity or changes made to your personal information.

For your peace of mind and security, each transfer to another person will have to be validated by entering a temporary transfer's code.

Visit the settings section on the left side menu of the mobile app, press Other Settings and slide the Log in with Face ID option.

Manage your accounts

Deposit accounts such as checking accounts, savings accounts, IRAs and CDs, as well as mortgage loans, auto loans and leases, personal loans, credit cards, and lines of credit.

You will be able to activate, view history and download your e-statements from the past 18 months, as well as view and download images of processed checks.

In the Account Services section, you may request a copy of your checks and your account statements, access to balances and reward points of your credit card, travel notifications; you can authorize FirstBank to contact you, request certifications of checking or savings accounts, order check books, cancel or replace debit cards, and/or stop payment on a check.

Access the Disclosure of Rates, Terms and Fees Applicable of each product for the details of the applicable charges in each of the deposit accounts.

You should make the request 7 to 10 business days in advance.

You will receive checking and savings account certification in 10 business days.

Transfers

Digital Banking allows you to make transfers between FirstBank accounts and other financial institutions in Puerto Rico, U.S. Virgin Islands and the United States. Limit for external transfers is $1,000 per day. No fee for next day. Same day transfers charge $3.99.

Watch the video tutorial in Watch and Learn channel or download the PDF for instructions on the process.

For added security, a unique 5-characters code is sent to your registered email address in Digital Banking to validate that you have requested a transfer to another account before processing the transaction. This code will be required for each transfer to other accounts (not between your own accounts). To receive the code in your email, you must press on "request code". Once you receive the code, you must enter it in the space provided and press “accept” to complete the transaction. You can copy and paste the code.

This code will have an expiration period of 5 minutes, after this period, the code will no longer be valid and you will have to request a new code. Each time a new code is requested, the previously issued access code will expire automatically.

Log into digitalbanking.1firstbank.com and click on the Transfers between other accounts section. In “Transfer “To” press “Other” and complete the required fields.

Please note that you will only be able to add other FirstBank accounts for credit purposes; you may not debit from these accounts.

Yes. You can set up recurrent transfers through digitalbanking.1firstbank.com in the Transfer section.

No. You can transfer money to other FirstBank accounts free of charge.

Payments

The platform allows you to make the following payments:

Adding new payees is easy through digitalbanking.1firstbank.com. Watch the video tutorial on Watch and Learn channel.

With Digital Banking, you may pay the following FirstBank accounts:

- Auto Loans and Leasing

- Mortgage Loans

- Personal Loans

- Credit Cards

- Lines of Credit

You can also make payments to accounts with other financial institutions in Puerto Rico, U.S. Virgin Islands and the United States through Bill Payments.

To pay off your loan, you must contact FirstLine Solutions at 1-866-695-2511.

Yes. You can issue a payment to any FirstBank loan with accounts from other banks in Puerto Rico, U.S. Virgin Islands and United States. These accounts must first be registered in digitalbanking.1firstbank.com.

Payments issued from your FirstBank accounts before 5 p.m. from Monday to Friday will be debited and processed on the same day. Payments issued after 5 p.m. or during the weekend will be processed the next business day.

Payments made using accounts from other banks will be processed the same day if issued before 5 p.m. Monday through Friday and will be debited to your account in 3 to 5 business days.

Yes. You can set up recurrent payments of bills and loans though digitalbanking.1firstbank.com.

You will receive notification through email including date, amount, account to be paid, and confirmation number. You may also view your payment status in the history section of Digital Banking.

- Bills: select from a list of over 4,000 registered merchants with your FirstBank accounts.

- Loans, Credit Cards, and Lines of Credit: Pay off your FirstBank mortgage loans, personal loans, boat loans, auto loans and leases, credit cards, and lines of credit with your FirstBank accounts or using accounts from other financial institutions in Puerto Rico and the United States.

Deposits

Making deposits through Digital Banking is easy. First, you will need to download the Digital Banking mobile app in App Store or Google Play. Watch the video tutorial on Watch and Learn channel.

Individual checking and savings accounts are eligible to deposit via your mobile device. To find out whether your account is eligible, contact us at 1-866-695-2511.

You will receive an email notification once your deposit is received, processed, approved, or declined.

Deposits will be available once it is validated and accepted by FirstBank. Any deposit made before 7 p.m. during a business day will be processed on the same day. This is subject to deposit verification and validation.

There is a limit of $10,000 per check per day and $20,000 total per month. The monthly cycle begins 25 business days after the date of the last deposit made through this service.

Notifications

You may set up notifications for your deposit accounts or credit cards balances, and your account activities such as payments, transfers, and deposits made through Digital Banking.

You will receive security alerts for failed sign-in attempts, when your account is open in two different devices (duplicate sessions), and alerts when you make changes in your security settings.

Programming notifications is easy. To do so, watch the video tutorial on Watch and Learn section.

Yes. You will be able to define the notifications and alerts for your accounts. For account balance, you can program receiving the notification based on any balance you may have or when the balance is higher or lower than a certain amount. Similarly, you will be able to set up the frequency in which you wish to receive the notification.

You may choose to receive them through email and/or as push notifications to your mobile device. These notifications will be in the language you configure your service.

Manage your Budget

You will have to categorize the transaction again as the service does not saves manual categorizations.

You will be able to see the history of your categorized transactions 45 days prior to service activation. The service will accumulate 12 months of transactions history.

Yes, your budget history will be saved for upcoming months.

We answer your questions.

COMMERCIAL ACCOUNTS

Commercial Checking accounts

This account can be opened by individuals, companies, clubs, associations, churches or corporations on behalf of a business or an entity (for profit or nonprofit).

You will have 24-hour access to account information through our FirstLine Solutions Center and Business Digital Banking.

The charge for checks cashed is $1.00 per item.

Commercial Maximizer Savings Accounts

You will need a copy of your business licenses, EIN/TIN number and two valid IDs, a completed signature cards and customer information sheet provided at the branch. Additional information such as: Trade name certificate, or application receipt (sole proprietorship, partnership, Partnership Agreement, and Partnership Certificate, (Partnership) Articles of Incorporation, Certificate of Incorporation and Corporate Resolutions (Corporation).

Yes, the Maximizer Savings Account allows you to earn higher interest and access your funds. You can make withdrawals without penalty, other than loss of interest.

Yes, you get to have an ATH debit card.

Commercial Statement Savings Accounts

The minimum to open a Statement Savings Account is $500. If you maintain the average minimum daily amount of $500, you can waive the fee.

A Statement Savings Account gives you the benefit of earning competitive interest, waiving fees, and access to an ATH debit card.

To see your account balances, you must first register with Business Digital Banking.

Commercial Certificate of Deposit

The minimum to open a Certificate of Deposit is $2,500.

A Certificate of Deposit is a smart way to save. It gives you the advantage of fixed rates for a term ranging from thirty days to five years and can be used as collateral for a personal loan.

We are here to help you.

Here you will find guides to help you in your digital transactions.