Good saving habits are taught and last a lifetime. First One Savings account is designed for kids under 18 years old. Teach them to save from the start.

Conforms to Gift to Minor/Custodial Accounts (UTMA) standards1

Mom and Dad can transfer funds from their accounts through Online Banking2

Top Market Rates

FIRST ONE SAVINGS ON YOUR MOBILE PHONE

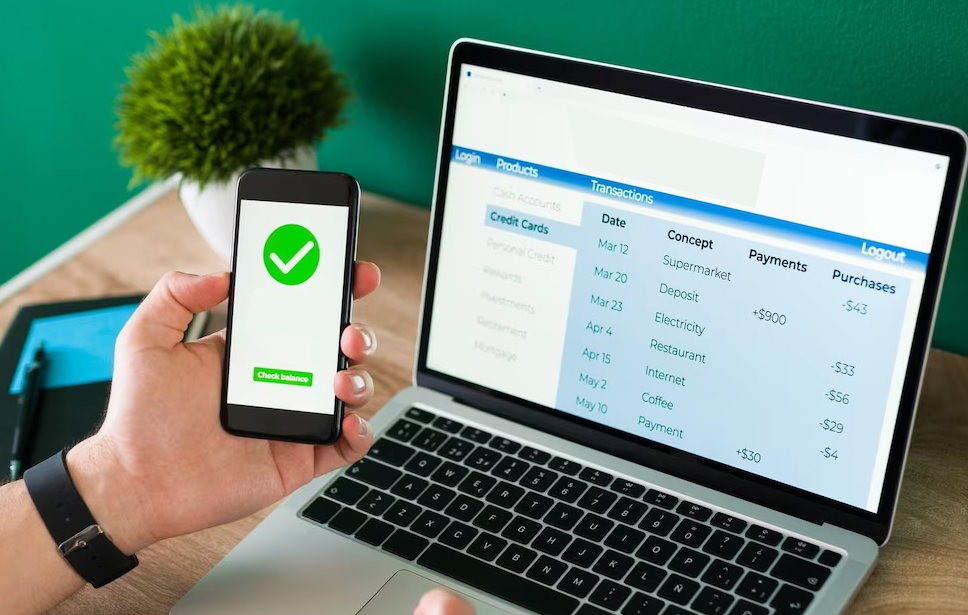

Simplify your life managing your savings account with our Online Banking mobile app.¹

Transfer money between eligible accounts

Access your account balance and payment history

Send money to family and friends with Zelle®

HOW TO APPLY

Ready to apply?

Make sure you have the following documents readily available.

In addition to your Social Security card, you will also need one valid ID with photo issued by the United States Government, such as:

-

Driver’s License

-

Passport

-

Military ID

-

Permanent Resident ID

-

Birth Certificate for minors

With these documents in hand, visit one of our branches.

ACCOUNTS THAT COMPLEMENT EACH OTHER

FREQUENTLY ASKED QUESTIONS

Yes, FirstBank has a savings account for minors. Our First One savings account is designed for them, and easy for you to manage. Plus, it conforms to the Gift to Minor/Custodian Accounts (UTMA) standards.

You can open a First One account with just $25. It is a good way to start teaching your child to save at an early age.

Yes, Mom and Dad can transfer funds through the personal mobile app and Online Banking.

Member FDIC. Account for kids between 0 and 18 years. A $1 monthly fee will apply if the balance falls under $25. See terms and conditions and Truth in Savings Disclosure for further information. Interest rates may change at any time. 1Only available if the parents are signers in the FirstOne Account. 2Online Banking is subject to FirstBank Florida terms and conditions.

Products and services available only in Florida. FirstBank Florida is a division of FirstBank Puerto Rico.