Open our Preferred Money Market account to enjoy higher interest rates and easy access to your money.

Access to more than 55,000 Allpoint ATMs nationwide 3

Ability to make transfers to or from your other accounts 2

Top Market Rates

Mobile Banking 4

Paper or Electronic Statement

Bill Payment

Telephone Banking 4

Visa Debit Card

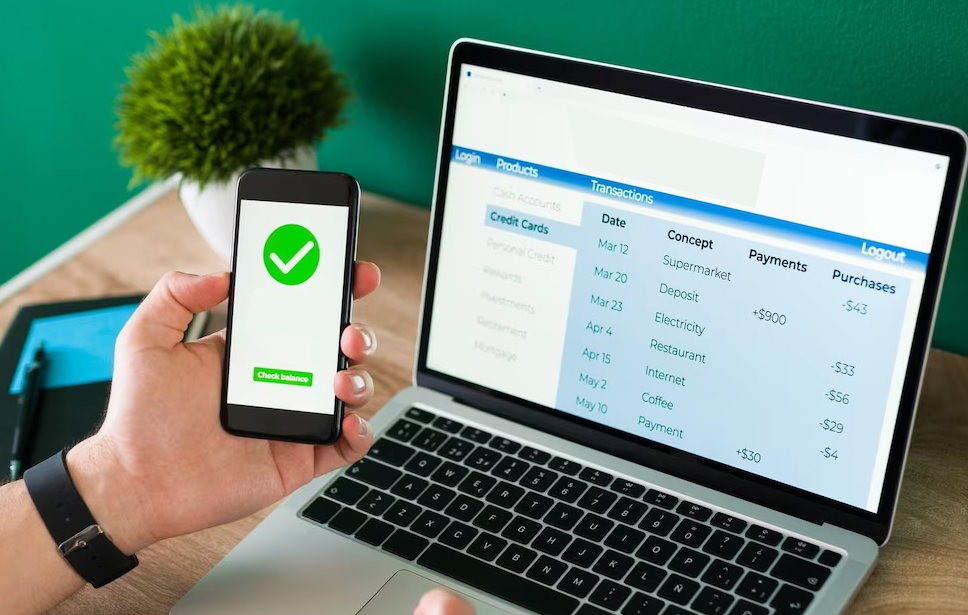

PREFERRED MONEY MARKET ON YOUR MOBILE PHONE

Simplify your life managing your savings account with our Online Banking mobile app.⁴

Transfer money between eligible accounts

Access your account balance and payment history

Send money to family and friends with Zelle®

HOW TO APPLY

Ready to apply?

Make sure you have the following documents readily available.

In addition to your Social Security card, you will also need one valid ID with photo issued by the United States Government, such as:

-

Driver’s License

-

Passport

-

Military ID

-

Permanent Resident ID

-

Government ID

With these documents in hand, visit one of our branches.

ACCOUNTS THAT COMPLEMENT EACH OTHER

FREQUENTLY ASKED QUESTIONS

A Preferred Money Market account is a savings account that earns interest at top market rate. So you have the chance to save more.

Yes, you get access to your account so you can see your money grow everyday through our Online Banking or our mobile banking app.

Yes, you can transfer between all your accounts at FirstBank.

Member FDIC. 1 Minimum deposit of $100 required to open account. If daily balance is less than $2,500, a $20 monthly maintenance fee will apply. No interest is paid on balances below $2,500. Interest rates may change at any time. Interest is credited monthly. Please refer to your Terms and Conditions Agreement and Truth in Savings Disclosure for more information. 2 Transfers from a Money Market account to another account or to third parties by pre-authorized, automatic, or telephone transfers and checks, drafts, or similar order to third parties are limited to six per statement period. After the sixth transaction per statement, a $5 fee per transfer will apply. 3 FirstBank Florida is a member of the Allpoint network, which offers access to more than 55,000 ATMs nationwide. 4 Online Banking, Mobile Banking and Telephone Banking services are subject to FirstBank Florida terms and conditions.

Products and services available only in Florida. FirstBank Florida is a division of FirstBank Puerto Rico.