Business Plus¹ commercial checking account gives you direct access to your funds, an optional line of credit and an investment module. Available for partnerships, corporations, clubs, associations, churches, or for-profit and not-for-profit entities and individuals Doing Business As (DBA).

A $10 monthly service fee will apply if the average balance in the checking and savings section is less than $2,500 2

Electronic transactions with no monthly fee.

A checking module for managing daily transactions

An investment module3 where you can automatically transfer excess operational funds to maximize their return

An optional line of credit4 from which you can make advance payments and is automatically activated to cover overdraft fees in case of insufficient funds

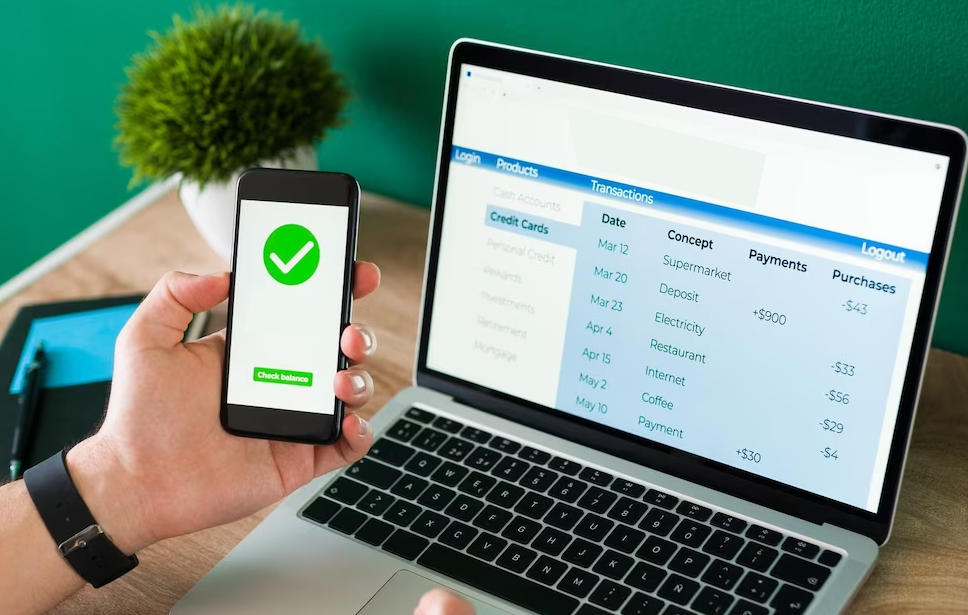

BUSINESS PLUS ON YOUR MOBILE

Enjoy a complete commercial banking experience with Business Digital Banking.³

Access your account information

Make transfers between accounts linked to your profile

Approve ACH and wire transactions, and Positive Pay and ACH Positive Pay exceptions

- 1

- 2

- 3

HOW TO OPEN AN ACCOUNT

Ready to open your account?

Make sure you have the following documents available before starting the process.

Valid ID with photo, such as:

-

Driver's license

-

Passport

-

Military ID

-

Government ID

In addition, the following documents:

-

Commercial Register

-

Municipal License

-

Utility bill

Additional requirements per legal entities:

Limited Liability Company (LLC)

-

Certificate of Incorporation

-

Articles of Incorporation

-

Operating Agreement

Corporation

-

Certificate of Incorporation

-

Articles of Incorporation

-

Bylaws

FREQUENTLY ASKED QUESTIONS

Business Plus is an account with maximum services. It gives you access to your funds, a line of credit, and an investment module.

Yes, we have the Business Plus DBA, Business Plus Corp, BFirst and Commercial Corp accounts that gives you access to an investment module. They are available for Doing Business As (DBA), Corporations and other legal entities.1

The Business Plus account does not have a monthly service fee if the account maintains a monthly average balance of $2,500 in the Business Account Plus Corp. or $2,000 in the Business Plus DBA; a monthly service fee of $10 applies if the required balance is not maintained.

Member FDIC. 1Certain terms and conditions apply. Only for customers in Puerto Rico. 2 The Business Plus account has no monthly service fee if you maintain an average monthly balance of $2,500 in the Business Account Plus Corp. or $2,000 in the Business Plus DBA; a monthly service fee of $10 applies if the required balance is not maintained. 3The investment module is available at the customer’s request. A monthly fee of $10 will apply in the Business Plus Corp. or $5 in the Business Plus DBA for maintaining a compensating balance with automatic transfers between the checking and savings sections. 4 Subject to credit approval and other terms and conditions. 5Certain terms and costs may apply.