The Preferente account combines checking and savings while giving you access to exclusive benefits such as: personalized service, Visa Infinite debit card and an optional reserve line.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

Exclusive Benefits

Exclusive Benefits

Exclusive Benefits

-

Preferente Officer who will provide you with individualized service and solutions to meet your financial needs

-

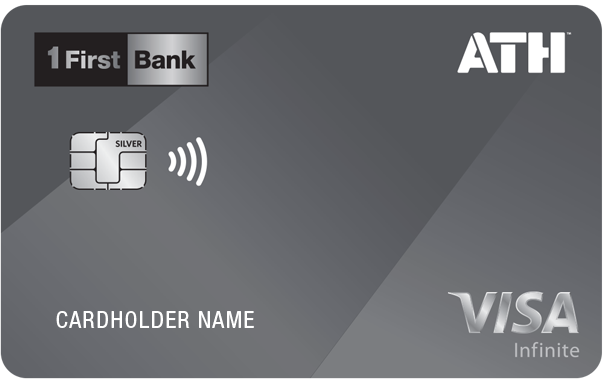

Visa Infinite debit card with worldwide acceptance and exclusive benefits

-

Exclusive turn for attention in cashier and services areas

-

Exclusive line thru FirstLine Solutions Center to the 787-281-2001

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

Deposit account benefits:

Deposit account benefits:

The Preferente account is designed for your everyday transactions and includes:

-

Checking section for your everyday transactions which generates interests1

-

Separate savings section (under the same account number) so you can save while earning interest1

-

First order of 25 checks free of charge (limited quantity)2

-

Over 55 branches and more than 300 ATMs throughout the Island

-

Quickly and safely access to your accounts thru Digital Banking3

-

Deposit checks through Depósito Expreso Móvil4

-

Transfers to your or third-party accounts at other financial institutions in Puerto Rico and United States5

-

Access to your statements for up to previous 18 months

-

Deposit checks and cash in our ATMs 24/7 Learn more

-

You can send, receive, transfer money between your registered accounts, make donations and payments to merchants through ATH Móvil6

-

Optional Reserve Line 7

Visa Infinite debit card

With the Visa Infinite debit card of the Preferente account you can enjoy exclusive benefits such as the Visa Nights program, Visa Digital Concierge, Visa Airport Companion, Visa Luxury Hotel and travel benefits and purchase protection, among others.

Account Opening Requirements

-

$1,500 mínimum deposit to open account

-

$25,000 average monthly balance to avoid monthly service fee8

Ready to open a deposit account?

Make sure you have the following documents⁹ available when you go to the branch to open a deposit account.

Contact Us

FirstLine Solutions Center

Customer Service / Sales / Payments

Monday to Sundays 6:00 a.m to 12:00 a.m.

FAQs

With the Preferente account you will have a series of benefits that will make your banking experience a different one, designed to be with your expectations and needs. It includes a checking and savings section under the same account number that generates interest in both sections1, a Preferente Officer for personalized service, and the option of a reserve line7 , among others.

Yes, you can register with one of our debit cards. With ATH Móvil6 you can make payments to more than 4,000 merchants and payments from person to person.

There is no monthly service fee if the average balance during the cycle is $25,000 or more. Otherwise, a $15.00 monthly service fee will apply. The balance of your Certificate of Deposit (CD) and Individual Retirement Account (IRA) with FirstBank will be added to the balance of both sections of the account to determine if the monthly service fee applies. For non-U.S. residents: There is no monthly service fee if the average balance during the cycle is $50,000 or higher. Otherwise, a $50.00 monthly service fee will apply. The balance of your Certificate of Deposit (CD) and Individual Retirement Account (IRA) with FirstBank will be added to the balance of both sections of the account to determine if the monthly service fee applies.

-

Access to benefits, promotions and exclusive discounts thru the Visa Infinite benefits website

-

Access, free of charge to FirstBank customers to more than 360 ATMs throughout Puerto Rico, the U.S. Virgin Islands, Tortola, and Florida

-

Carry out transactions easily, quickly and securely at points of sale and ATMs that use Contactless technology10

-

Exclusive services for travelers: Visa Airport Companion, Visa Digital Concierge

-

Making payments and transfers through the ATH Móvil6

-

Receive fraud alerts via text message and/or email11

The minimum opening deposit for the Preferente account is $1,500.

Member FDIC. Only for individuals. Subject to the terms and conditions included in the Deposit Account Agreement and the Disclosure of Applicable Fees, Terms, and Interest Rates in Deposit Accounts, which were provided when you opened the account. 1The interest rate and annual percentage yield (APY) applicable to the accounts may vary at the discretion of FirstBank, based on market conditions, and may change without prior notice. 2Prices and terms set by Harland Clarke will apply to additional orders. 3Digital Banking is subject to FirstBank’s terms, conditions, and restrictions. 4 Your deposit will be available according to FirstBank’s Funds Availability Policy, included in the Deposit Accounts Agreement. 5By using the functionality, you accept and acknowledge that the Functionality may have changes at any time, at FirstBank's discretion, including, but not limited to: modification in the limits to transfer, revoke the Functionality at any time, even if any transfer is pending, or add additional clients or types of accounts at any time, among others. 6 ATH Móvil is subject to FirstBank's terms and conditions. Using ATH Móvil requires the titleholders of both the receiving and issuing accounts to be registered service users. To enroll, you must have an active debit card with a participating financial institution in the ATH Móvil service. Download the ATH Movil application to register and view the terms and conditions of service and a list of participating institutions. ATH Móvil is an ATH® Network service from EVERTEC Group, LLC. 7 The reserve line is optional and subject to credit approval. 8 There is no monthly service fee if the average balance during the cycle is $25,000 or more. Otherwise, a $15.00 monthly service fee will apply. The balance of your Certificate of Deposit (CD) and Individual Retirement Account (IRA) with FirstBank will be added to the balance of both sections of the account to determine if the monthly service fee applies. For non-U.S. residents: There is no monthly service fee if the average balance during the cycle is $50,000 or higher. Otherwise, a $50.00 monthly service fee will apply. The balance of your Certificate of Deposit (CD) and Individual Retirement Account (IRA) with FirstBank will be added to the balance of both sections of the account to determine if the monthly service fee applies. 9FirstBank may solicit additional information or documentation.10Contactless chip card transactions offer the same level of security as a contact chip card if used at a chip-enabled terminal. 11 You may receive fraud alerts by e-mail and/or text message for suspicious or fraudulent transactions, as long as your information is registered correctly in our systems and your service provider has the service available.